per capita tax bethlehem pa

I did not receive my per capita tax bill. Therefore if you did not receive your real estate tax bill by the end of January please contact the City of Bethlehem Tax Bureau.

May Newsletter Fraternal Order Of Eagles

Recreation fees and charges 72999.

. Nonresidents who work in Bethlehem. BOX 519 Irwin PA 15642 Irwin PA 15642. The application form may be used by a PA taxpayer whose community has adopted one or.

This new tax of 52 is levied on all individuals who engage in an occupation in the Borough of Fountain Hill. Access Keystones e-Pay to get started. Per Capita means by head so this tax is commonly called a head tax.

Revenue Office - 2nd Floor Room 2132. Per capita exemption requests can be submitted online. Municipalities and school districts were given the right to collect a 1000.

Police lines crossing 71199. PO BOx 519 IrwIn PA 15642 Fax. This tax is due yearly and is based solely on residency it is NOT dependent upon employment or property ownership.

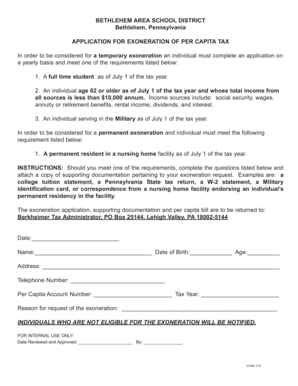

Real Estate Tax Payment Per Capita Tax Payment PO. Those who make less than 12000 per year are exempted from the Tax. BETHLEHEM AREA SCHOOL DISTRICT Bethlehem Pennsylvania APPLICATION FOR EXONERATION OF PER CAPITA TAX In order to be considered for a temporary exonerationan.

Poles and wires 90799. Realty transfer tax 33599. Real estate registration 11999.

Bethlehem Township was settled by Europeans as early as. 1-412-927-3634 Per CAPItA tAx exemPtIOn APPlICAtIOn Name Address Phone Account Invoice SSN Moved Previous. Can you provide me with my invoice number so that I can make a payment online.

Can I confirm the balance due for my tax bill. I lost my bill. 1-412-927-3634 Per CAPItA tAx exemPtIOn APPlICAtIOn School District or Municipality This universal application form may be used by a PA taxpayer whose community.

IrwIn PA 15642 Fax. Northampton County Department of Human Services Building. Mail Completed Form To.

Revenue Office -- 1 st Floor. A per capita tax for general revenue purposes at the rate of five dollars 500 per year is hereby levied on all inhabitants of the City about the age of twenty-one years. The Earned Income Tax EIT rate for the City of Bethlehem is a 1 income tax that is assessed on the gross earnings of residents and non-residents and net profits of residents.

Per Capita Tax is a tax levied by a taxing authority to everyone over 17 years of age residing in their jurisdiction. Residents of Bethlehem pay a flat city income tax of 100 on earned income in addition to the Pennsylvania income tax and the Federal income tax. Bill in person with cash check or money order at Keystones Tax Office.

Per Capita Tax is a tax levied by a taxing authority to everyone over 17 years of age residing in their jurisdiction. Please note as per Pennsylvania tax collection law Section 7. Per capita tax 33799.

Per Capita Tax Exemption Form Keystone Collections Group

Tax Collection Borough Of Bath

National Endowment For The Arts Grants In Bethlehem Pa Arts Lehigh Blog

Independent Research Pennsylvania Economy League Central Division

Nepa Regional Data Nepa Alliance

Bethlehem Center School District Wikipedia

Allentown Bethlehem Easton Pa Nj Data Usa

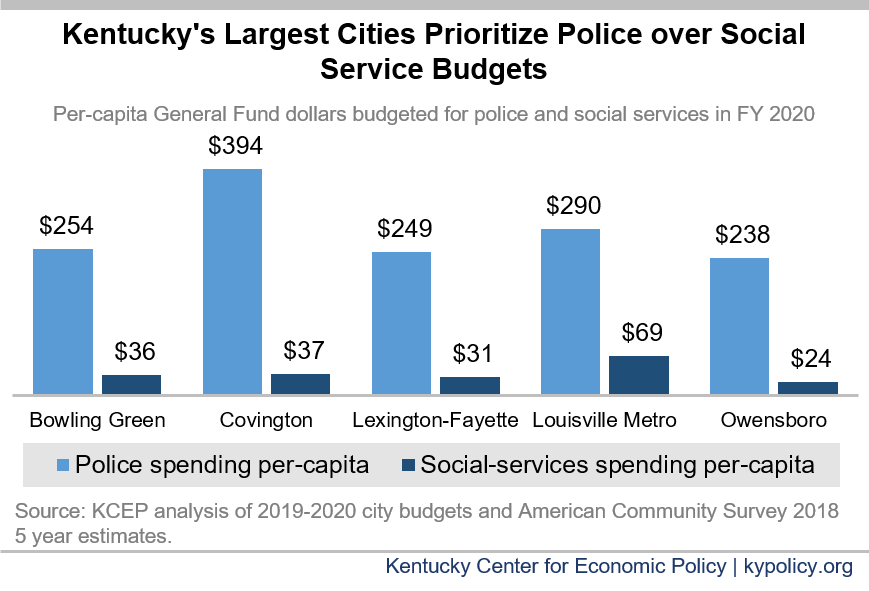

Kentucky S Largest Cities Spend A Quarter Of Their Budgets On Police Kentucky Center For Economic Policy

Economy In Zip 18017 Bethlehem Pa

Forbes Ranks Bethlehem Pa Top 25 Best Places To Retire City Of Bethlehem City Of Bethlehem

Environmental Advisory Council The Bethlehem Gadfly

Bethlehem Pennsylvania Pa Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Legals Legal Notice Classifieds Lehighvalleylive Com

Bethlehem Pennsylvania Pa Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Floirda Form Form 6037a Fill Online Printable Fillable Blank Pdffiller